What is an Amortized Installment Sale (AIS)?

Amortized Installment Sale (AIS) Explained

Overview

An Amortized Installment Sale (AIS) is a financial strategy that allows sellers of high-value assets—such as real estate or a business—to defer capital gains taxes. Instead of receiving the sale proceeds directly, which would trigger immediate taxation, the funds are directed from escrow into a trust. The seller, in return, receives a promissory note outlining a structured series of payments that include both principal and interest over a set term (5, 10, 15, or 20 years).

This strategy is best suited for:

Investment Property

Collectables

Businesses

Highly Valued Residential Property

Why Use an Amortized Installment Sale?

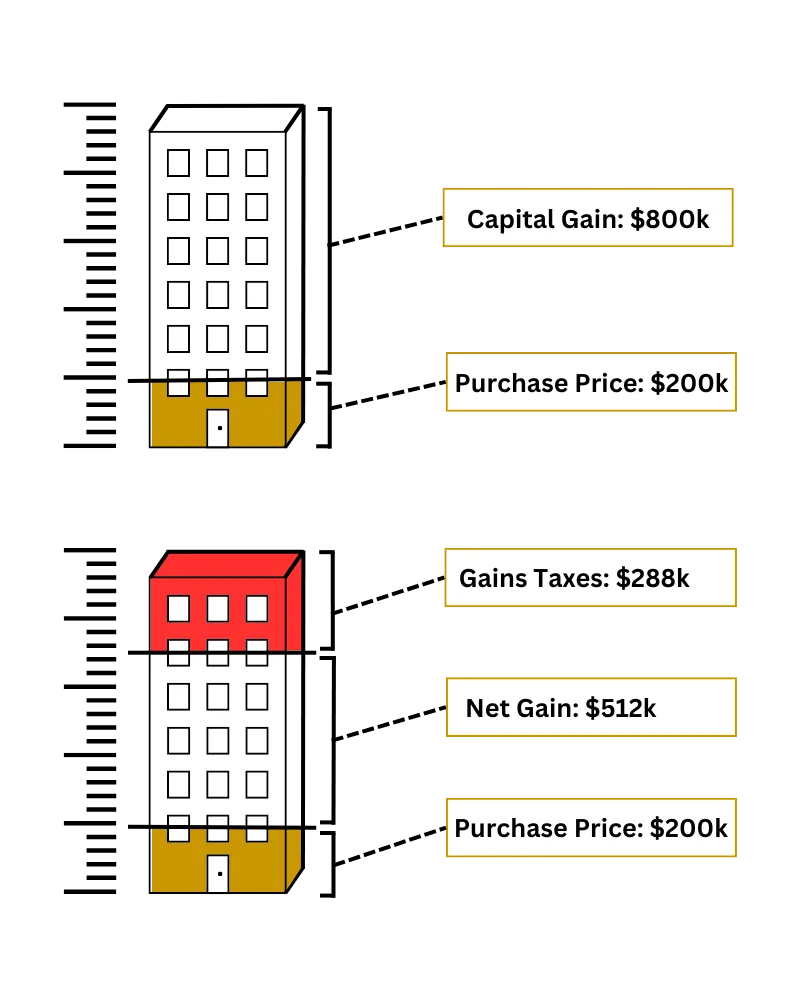

When selling a major asset, sellers often face substantial capital gains taxes. Depending on their tax bracket, these taxes can eat up over 20% of the profit—before accounting for any state-level taxes. This immediate tax obligation reduces the capital available for reinvestment, retirement, or wealth preservation.

Here are some of the key benefits of using an AIS.

Defers capital gains taxes over time (IRC Section 453)

Avoids a large upfront tax payment

Keeps seller in a lower tax bracket

Earning interest on pre-tax funds (compounding power)

Predictable income via scheduled principal + interest payments

Estate planning flexibility with structured distributions

How an Amortized Installment Sale Works

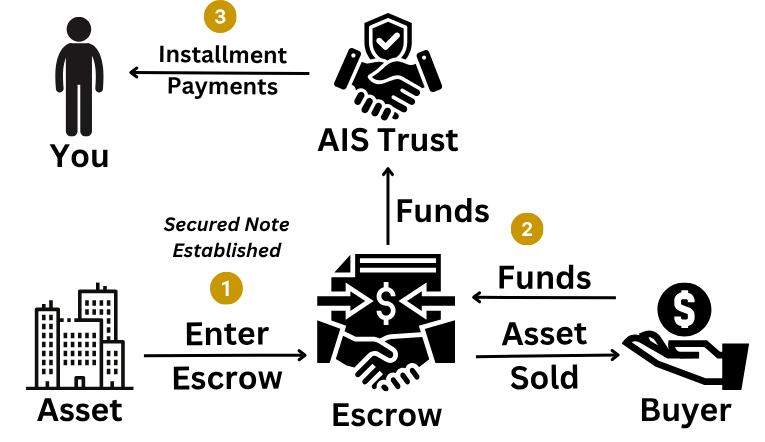

Instead of receiving sale proceeds directly, the funds go to a trust and you get a promissory note. This note pays you interest + principal over a selected time frame, allowing you to avoid immediate tax.

1. Promissory Note Issued

You select the payment terms for a secured note that match your income goals. Our Team Administers the note, and both parties sign. The trust issues a note to the seller, detailing payment amounts, interest rates, and terms.

2. Asset Sold & Escrow Funds Enter IGH Trust

Instead of releasing the funds to the seller, escrow sends them to a dedicated trust in the form of a loan from the seller. At the close of escrow, the proceeds directly enter the Iron Gate Holdings trust. The buyer deposits funds into an escrow account.

3. Deferred Taxation Begins

The seller receives regular payments according to the promissory note they selected. The seller is now deferring the capital gains tax burden while collecting a predictable income.

The Promissory Note: Principal + Interest

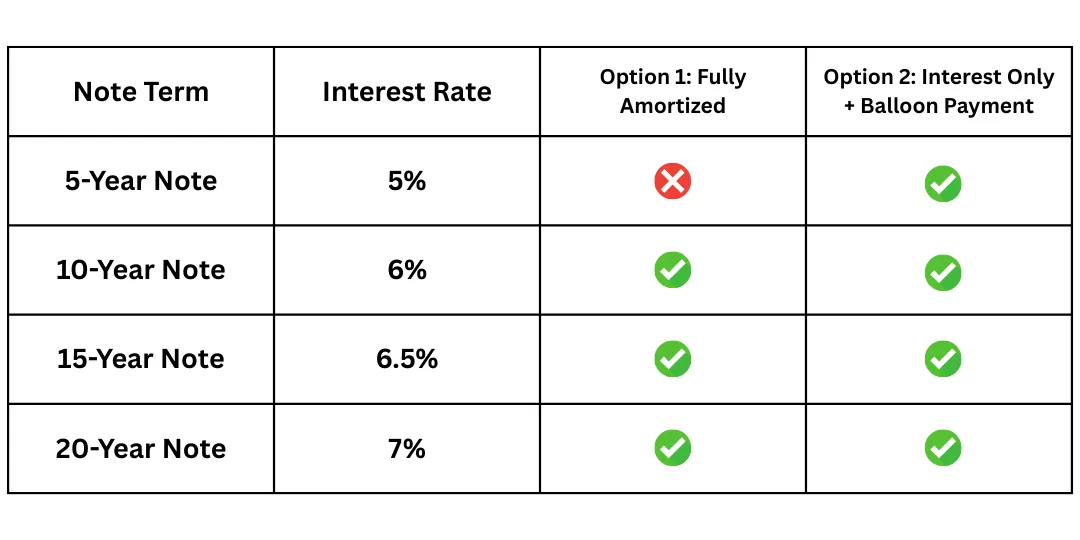

At the heart of an AIS is the promissory note issued by the trust to the seller. This legal document outlines the amount of money owed, the repayment period, and the interest rate. Depending on the term selected, the payment structure can vary significantly:

5-Year Note: 5% Interest-only payments for five years, followed by a balloon payment of the principal at the end.

10-Year Note: Fully amortized payments at a 6% fixed interest rate or 6% Interest-only payments for five years, followed by a balloon payment of the principal at the end.

15-Year Note: Fully amortized payments at a 6.5% fixed interest rate or 6.5% Interest-only payments for five years, followed by a balloon payment of the principal at the end.

20-Year Note: Fully amortized payments at a 7% fixed interest rate or 7% Interest-only payments for five years, followed by a balloon payment of the principal at the end.

The Role of Escrow and the Trust

Escrow ensures all sale conditions are satisfied and securely handles the transaction. The trust receives the sale funds and acts as the intermediary, managing the money and issuing payments to the seller according to the terms of the promissory note. This legal structure is crucial for avoiding constructive receipt.

Constructive Receipt: What It Means and Why It Matters

Constructive receipt is a tax principle where income is considered received when it is made available to the taxpayer, even if not physically in hand. AIS avoids constructive receipt because the seller never directly touches the sale proceeds—the funds go from escrow to the trust. This key distinction qualifies the transaction for tax deferral under IRS Section 453.

What IRS Code Does an AIS Follow?

AIS follows IRS Code Section 453 and Publication 537, which outline the installment method for spreading out taxable gain over multiple years. It’s fully IRS-compliant and widely used for large sales.

IRS Code Section 453

Allows taxpayers to defer capital gains taxes when they sell an asset and receive payments over time, rather than in a lump sum. You only pay taxes on the gain as each installment payment is received. This method spreads out the tax burden and helps keep sellers in a lower tax bracket.

IRS Code Section 453 governs installment sales, allowing sellers to recognize gains proportionally as they receive payments, rather than all at once. AIS fully complies with this provision by ensuring that sellers only receive payments through a structured note, not the original proceeds.

IRS Publication 537

The official IRS guide that explains how to report income from an installment sale. It provides clear rules on calculating gain, reporting interest, and maintaining compliance when using the installment method under Section 453. It also explains how to avoid "constructive receipt" that would trigger immediate taxation.

IRS Publication 537 provides specific guidance on how installment sales should be reported, including rules for interest, payments, and gain calculation. AIS strategies are crafted to align precisely with these guidelines, ensuring IRS compliance while maximizing tax efficiency.

Compliance is key to an AIS. We only use approved structures in accordance with IRC 453 and Pub 537. Here's how we stay compliant:

No constructive receipt — seller never touches the funds

No personal loans or backdoor access to the trust (monetizing)

A fiduciary trustee manages the assets

Secured promissory note terms are documented and transparent

Take the Next Step: Get Your Custom Amortized Installment Sale Revenue Estimator Report

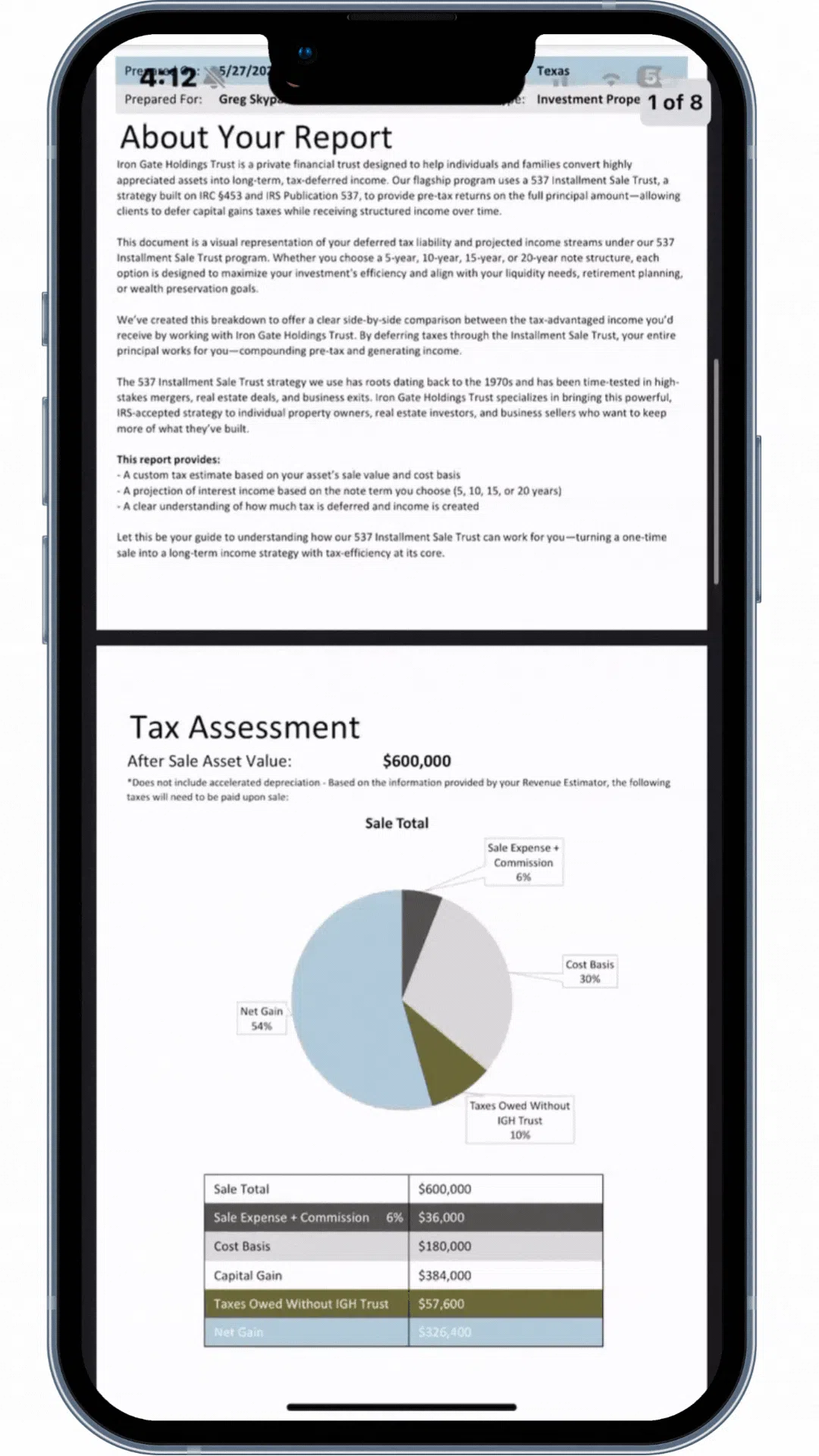

Choosing the right payment structure is a key part of maximizing the benefits of an Amortized Installment Sale. To help you make an informed decision, we’ve created a free, personalized Revenue Estimator Report that outlines:

Your total tax liability with and without AIS

Expected quarterly payments for 5, 10, 15, and 20-year options

Pre-tax investment growth over the life of the note

Side-by-side projections comparing traditional sale vs. AIS

Whether you’re considering a 5-year interest-only note or a 20-year fully amortized plan with 7% returns, this report shows exactly how each choice impacts your wealth, income, and long-term tax savings.

FAQ

Is an Amortized Installment Sale (AIS) legal and IRS-compliant?

Yes. AIS is fully compliant with IRS regulations when structured correctly. It is based on IRS Code Section 453 and detailed in IRS Publication 537, which allow for the deferral of capital gains taxes through installment sales. The key is avoiding constructive receipt by routing funds through a trust—not directly to the seller.

Can I access my funds early if I need them?

AIS is designed for long-term planning, but custom liquidity strategies can be incorporated during setup. In some cases, you may negotiate early access or adjust payment structures during refinancing. However, accessing large sums early may trigger partial tax recognition, so it should be planned carefully with your Iron Gate Holdings representative.

What happens if I pass away before the note is fully paid?

If the note holder passes away, the remaining balance of the AIS note is transferred to their heirs or designated beneficiaries as part of the estate. The trust and note structure remain intact, continuing to pay out under the original terms. This feature makes AIS a powerful tool for estate planning and intergenerational wealth transfer.

How do I choose between a 5, 10, 15, or 20-year payment structure?

Each term offers unique benefits:

5-Year: Interest-only payments with a balloon payment; more liquidity early on.

10-Year: 5% interest with full amortization; balance of cash flow and tax deferral.

15-Year: 6.5% interest; higher compounding, more income.

20-Year: 7% interest; maximum tax deferral and long-term wealth growth.

To make the best decision, request a custom estimator report comparing your options based on your asset, tax profile, and retirement goals.

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.