What is a 537 Installment Sale Trust (IST)?

A 537 Installment Sale Trust (IST) is a trust arrangement that combines special-purpose vehicles with installment sales. This financial strategy is commonly used in property transactions, especially for business sales, to defer capital gains tax over time. When structured correctly, assets can grow from the entire principal amount sold to the trust, growing from the returns earned on taxes you deferred. This deferral can go on for generations.

Income is the primary goal of the IST. We can maximize income by deferring the tax, then compounding growth and return from the deferred taxes. With this strategy, we can yield additional returns from cash that would have otherwise been subject to capital gains tax.

First used by Ernst & Ernst (Ernst & Young) for internal clients, in 1971, the IST method has been around for decades. The 537 Installment Sale Trust strategy is 100% IRS Compliant:

Untaxed on the way in

Investment Growth

Taxed as Income, Gains, or Basis on the way out

The 537 Installment Sale Trust uses IRS Code Section 453, with assets secured in a Business Purpose Trust. The idea behind this strategy is to defer the taxes. Since proceeds go into the trust instead of your bank account, there is no constructive receipt. Thus no 'taxable event'.

Additionally, cash within the trust is invested for a return, and cash liquidity for other investments without the complexities and timelines of a 1031 Exchange. For this reason, it poses a great alternative to a 1031 Exchange.

What is a Structured Installment Sale?

The Internal Revenue Code (IRC), specifically Section 453, lays out the rules for an "installment sale." So what's an installment sale? When selling a property, instead of getting all the money upfront, you'll get paid in installments over time.

Typically, when you make a gain, you have to pay taxes on it right away. With installment sales, you only owe tax on the money you've received. This is called the "installment method" of accounting.

This method allows you to push the recognition of your gains from the sale into future tax years, when you receive the payments. If you sold a property that increased in value over time, You only report and pay tax on the gains you received in the current tax year.

This method can also be used instead of a Section 1031 Exchange. 1031 is the rule for exchanging one property for another without paying taxes immediately. An IST can also be used as a safety net, allowing you to use the IST or installment method if a 1031 exchange fails.

There are specific rules about when you can access the gains from the sale. If you stick to these rules, you can still report your income using the installment method even if the exchange fails or goes into the next tax year. For this reason, ISTs are an excellent way to save a failing 1031 exchange.

How Does a 537 Installment Sale Trust Work?

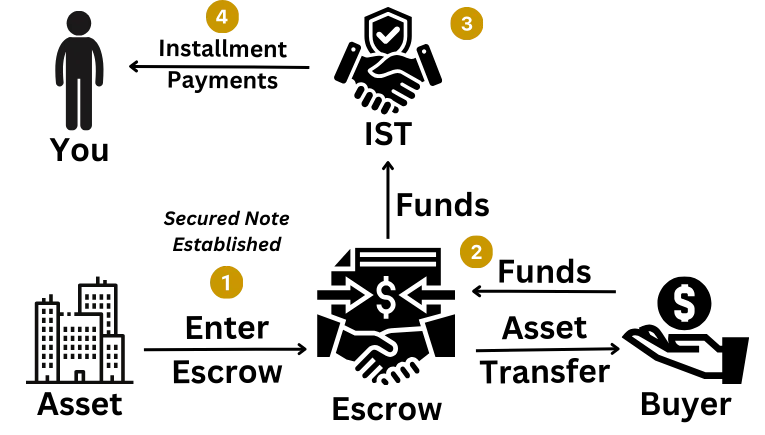

Step 1: Our team administers the IST and creates terms for a Secured Note for the seller's protection.

Step 2: At close of escrow, the proceeds directly enter the trust.

Step 3: The Trustee invests proceeds for a significant return aiming at both income and growth.

Step 4: The note pays out quarterly income. From here, the process can continuously be repeated.

Fully IRS Compliant

The IST defers the Capital Gains Taxes from the transaction. When you receive income from the trust, you pay income tax based on your tax bracket, like any other income.

We ensure compliance by using a third-party trustee service, IST Admin Services, or CB Admin Services.

The assets within the trust can not be directly under your name to avoid constructive receipt, causing taxes owed immediately. The Secured Note and Fiduciary Trustee Service protects your interest entirely. With the Secured Note granted to you, the Note collateralizes the Trust Assets, providing your security.

We are fully transparent about the process and are happy to talk to your CPA or Attorney about any specific questions.

We have trained hundreds of CPAs over 20 years in business and will happily talk to yours, too! We are not hiding any cards and are more than willing to answer any additional questions you, your lawyer, or your accountant may have.

For additional legal questions, please contact us at +1 (800) 345-9808.

Liquidity / Income / Withdrawals

The most unsettling part about most tax-deferring transactions is the loss of liquidity. With the IST you can withdraw or take an income stream from the principal invested.

Therefore, if you want to leave the IST and place all the funds in your bank account, you are allowed to do so- you will have to pay any taxes owed from the original sale. Or you can Refinance the Note and make a withdrawal of a portion of the assets. We do not charge extra for those services. This is one of the most appealing parts of the IST because it gives you more options.

Trust Investments Require Your Approval

Upon selling your asset to the IST, you receive a Secured Note. According to Investopedia.com, “A Secured Note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral.” This means that the Trust assets are tied to your Secured Note.

For example, the bank receives a secured note against your house (mortgage) or car (auto loan), which states that you are to give your asset to the bank if you don't pay. This works similarly with the IST.

So, how is this secured?

You approve the investments that are collateral for your Note. For example, if you do not want to use our investing strategy, you can choose other investments as collateral. However, if you choose to do this, you may lose some or all guarantees.

The Trustees generally use principally insured investments combined with proven investment strategies to ensure guaranteed payment to the Secured Note.

Profit/Gains from Deferred Taxes

Here's how it works:

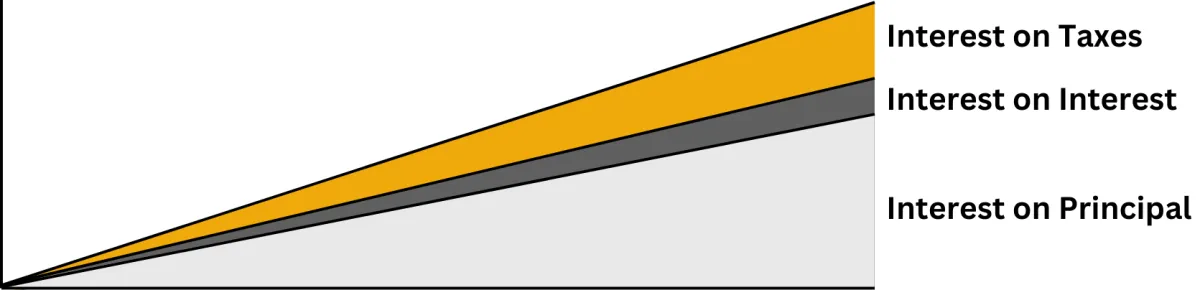

When you sell an asset through an IST, the proceeds from the sale are invested by the Trustee. The gains in the Trust are not taxed until withdrawn, which allows growth over time without the immediate loss of taxation. This offers three distinct levels of compounding interest.

1. Interest on Principal: This is the most straightforward level of compounding. The principal is invested. The returns or interest from this investment are added back to the principal, thus increasing the total amount of money that can earn interest.

2. Interest on Interest: As the interest from the principal is reinvested and generates its own interest, a second layer of compounding. Over time, this can significantly increase the growth of the investment.

3. Interest on Taxes Saved: Finally, because the money in the IST is not immediately taxed, the amount that would have gone towards taxes is instead earning interest. This is effectively another layer of compounding, allowing the funds that would have been lost to taxes to contribute to the overall growth of the Trust.

By utilizing these three layers of compounding interest, a 537 Installment Sale Trust can help the proceeds from a sale grow significantly over time, maximizing the benefit of tax deferral.

Ongoing Income & Generational Income Planning

The IST may be passed on to heirs. When the promissory note is passed on, there may be a step up in basis. This calculation is complex and unique for each situation, we can discuss this with you specifically.

This allows your heir to either take the cash or receive an income stream. This makes the IST an excellent generational wealth tool for succession and estate planning.

Where Does the Tax Go?

It's crucial to note that the deferred tax liability does not disappear. The IST just defers the ‘taxable event.’ The capital gains tax is then paid as the seller receives the IST income. The key benefit lies in the deferral and potential for the overall tax burden to be spread out. With asset appreciation combined with specific, proper management, the Trust's growth will outperform the income tax rate, allowing much more income.

All that being said, using financial strategies we will provide, it is possible to greatly reduce or completely eliminate the effective capital gains tax from the sale, over time.

We would like to note that you cannot monetize the secured note itself or else this turns into a monetized installment sale, which is NOT IRS compliant and will result in paying penalties in addition to capital gains tax. The monetized installment sale is only allowed for farm or agriculture related transactions. You can learn more about the monetized installment sale through our partner company, CB Farmer's Trust.

Who Benefits From an IST?

Anyone who owns a business, commercial real estate, investment real estate, or most highly appreciated assets, may qualify for a 537 Installment Sale Trust. Homeowners looking to downsize, landlords, investors, and business owners typically benefit the most. A 537 Installment Sale Trust is the ONLY option that allows you to have a steady guaranteed income for years after selling your asset. The next generation can also inherit this income, so your investments will live on.

IST FAQ

"Can I do this with my own Trust and why do I need a Trustee Service?"

No, you cannot use this for your own trust as that has a different purpose. Additionally, you cannot be the Trustee of the Trust. This would violate the necessary Arms Length and Related Party Doctrine of the tax code. You have extended rights and security as owner of the promissory note, which fully protects and collateralizes your assets in the Trust.

Similarly to a 1031 where you can't facilitate your own exchange, you cannot facilitate your own Installment Sale Trust. The reason being, there has to be a business purpose outside of solely deferring the taxes for the IRS to consider this being a commercially viable transaction.

The Trustee service for the IST transactions can be found here https://istadmin.com/about.

"Do I have to put all my gains in the Trust and can I take out my basis?"

No, similar to a 1031, you can take out "boot" in the transaction and have the flexibility to pick and choose when, how, and if you ever pay the tax. We generally recommend, if possible, only putting the taxable gain portion of the sale inside the trust.

There are methods to take your basis out before close of escrow untaxed and for personal residences specifically, taking out your additional federal exemption of $250K or $500K. But, if you want a larger, passive income, and do not require a large sum of cash, you can accomplish this by putting the entire sale proceeds inside the trust and generating a larger income stream.

What are the main rules inside the IST to stay compliant?

The IST has a lot of flexibility with the ability to re-enter real estate, defer income, solve debt, invest in stocks, bonds, and more. But, there are rules to keep in mind before pulling the trigger.

-The IST cannot invest more than 50% of the funds in one Investment. With having an Accredited Investment Fiduciary manage the money and Fiduciary Trustees, we have a higher level of obligation to you in comparison to your typical advisor or money manager. If we allowed for bad investment decisions and were not diversified we would lose our licenses and trigger lawsuits, malpractice claims, and more.

But, we will happily look into and accept outside investment vehicles as a means of investing the funds inside the IST if they check the right boxes.

-The IST cannot invest funds to purchase a personal residence, asset, or secondary home. Think of it this way, if it is not something generating you a return and is something simply for your own personal pleasure it is not a viable use of funds inside the IST. Doing this could very easily trigger an audit and a taxable event.

-Once you pull out funds, they are taxable to you. Similar to how an LLC operates, the IST is a pass through entity and comes down to you. You get taxed based on what you extract so keep that in mind if you decide to pull additional funds outside your income stream.

Does the IST get a step-up in basis like real estate?

Yes. The Installment Sale Trust structure gives you more flexibility and powers on receiving the step-up in basis. The IRS treats the Note you hold against the IST as a Security and Securities receive a step-up in basis. If you would like some more information on this such as TAMs (Technical Advice Memorandums) or Revenue Rulings please give us a call so we can email you the information!

Does the IST have a minimum requirement?

Yes, the IST has a minimum requirement of $500,000 because of the fee structure being so low. Anything less than that, the fees are not able to cover the expenses that the Trust has with accounting, tax returns, bank accounts, management and more.

But, if you plan to do more than one transaction inside the Installment Sale Trust we can start under $500,000 and eventually insert the additional capital gains on the next transaction to hit the sum of that number.

Do I need multiple ISTs if I am selling more than one property or business?

No, there is no need for multiple Installment Sale Trusts. Once you have one, you can do an unlimited amount of transactions inside. It is going to feel like a Traditional IRA Account with the context that you put income in to defer the income taxes in one account but in this case with the IST it is one Trust account made for capital gains deferral.

How do I know my money is secure?

As the Note Holder, your collateral is all of the assets in the Trust. No money movement or investments can be made without your approval. These Trust accounts have DACA Agreements Authenticator apps, and more security that require you to approve any investments or withdrawals from the Trust and prevent us from being able to commit fraud or malpractice.

Chances are, this will be the most secured account you ever have had or will have in your life. We intentionally put all of these security measures in place because if we were on your side of the table, we would expect the same.

Along with this, we have Fidelity Bonds, E&O Insurance, and more that cover your funds in the event that there was malpractice or fraud. If we somehow found a way to convince you to send us all of your money, you would be made whole and more.

Where does the IST come from?

The IST is a variation of the old Ernst & Ernst program before they became Ernst & Young that was created to help their partners exit without the capital gains tax liability. This was not a creation of ours, but something that we learned from them and applied to our own business. With this model, we have been able to help facilitate 3500+ transactions in over 20 years.

The Installment Sale Method is the backbone for Mergers and Acquisitions deals and has been a staple for large companies such as Fedex to help their line haul route owners sell their routes with preferred terms and no capital gains tax liability due at close.

What happens if I get audited?

We have never had an audit in the years we have been doing business, but, in the event that there was one, we would represent you. We have Tax Attorneys, CPAs, and more professionals that back this strategy along with IRS Revenue Rulings and Technical Advice Memorandums to base our defense on.

There is no cost associated with us defending you. That is fixed into your Trust administration fee.

Our philosophy is to communicate with the IRS, not hide from them. We do our best to have annual conversations with IRS auditors and ensure that we are facilitating the IST in a compliant fashion and staying outside of any 'gray areas.'

Do I have to perform a carry back or seller financing for the property/business?

No, the IST does not need to perform any carry back or seller financing like a typical Installment Sale. The entirety of the proceeds land inside the Installment Sale Trust and you can opt in to receiving Installment Payments from the interest accrued or deferring the payments inside of the Trust.

Depending on the transaction, we can perform a carry back with the Installment Sale Trust. This is a case-by-case situation and must be discussed with an IST advisor.

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.